Connecting Tax, SAP and Controls?

KGT is a dedicated consultancy firm specialized in

SAP DRC and tax services

We are specialized in configuring SAP DRC to support businesses efficiently generate, validate, and submit e-invoices, e-documents, and statutory reports, including those related to indirect taxes. Our SAP-certified experts bring extensive experience from successful projects with international companies, ensuring compliance and process efficiency. As a boutique SAP tax consultancy independent of audit restrictions, KGT provides specialized support tailored to your business.

Discover the KGT Knowledge Platform

At KGT, we believe that informed tax professionals drive better business decisions. That’s why we created GlobalIndirectTaxManagement.com, our dedicated knowledge platform for global indirect tax management.

There, you’ll find:

- KGT Country Updates – concise overviews of the latest VAT, GST, and e-invoicing developments across jurisdictions.

- In-depth articles on Tax Control Frameworks – offering expert perspectives, actionable guidance, and proven approaches from real-world practice.

The platform brings together expertise from KGT’s international network and offers valuable perspectives for Tax, Finance, and Compliance leaders seeking to strengthen control and create value through tax transparency.

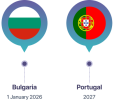

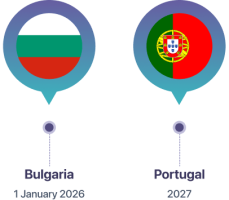

Future developments in Europe

E-Invoicing

SAF-T

Events

Stay ahead in the ever-evolving world of tax technology. Our events bring together experts, SAP users, and industry leaders to share insights, explore innovations, and discuss the future of tax reporting and compliance. From interactive webinars to in-depth workshops and exclusive roundtables, KGT events are designed to provide practical knowledge and actionable strategies you can apply within your organization.

Discover upcoming events and be part of the conversation.