Configuration of the SAP's ACR solution for SAP HANA

The 'Advanced Compliance Reporting' (ACR) service enables you to configure, generate, analyze, and electronically submit statutory reports that contain indirect taxes, such as value-added tax. The tax computations in these reports following government's guidelines. Statutory reports contain transactional data in legally defined formats. The feature generates tax reports in legally defined formats such as PDF, XML, and JSON and contains correction reports to rectify errors in submitted reports. You can analyze report output data for generated reports based on various dimensions and measures.

KGT provides SAP HANA configuring support for ACR to generate and submit statutory reports that comply with government guidelines. We work closely with the SAP product team based in San Jose, California, due to our SAP tax expertise.

SAP Localization Hub, an advanced compliance reporting service and comes with the following applications:

- Configure Source Systems helps you define source systems from which data must be replicated.

- Configure Reports enables you to configure reports and set their validity, reporting activities, user authorization, and periodicity.

- Collect Report Data enables you to copy data using Microsoft Excel templates and APIs.

- Run Advanced Compliance Reports allows you to generate reports and submit them to the government.

- Configure Report Communication will enable you to configure report submission units for online report submission.

- Report Communication Logs will enable you to view report submission logs.

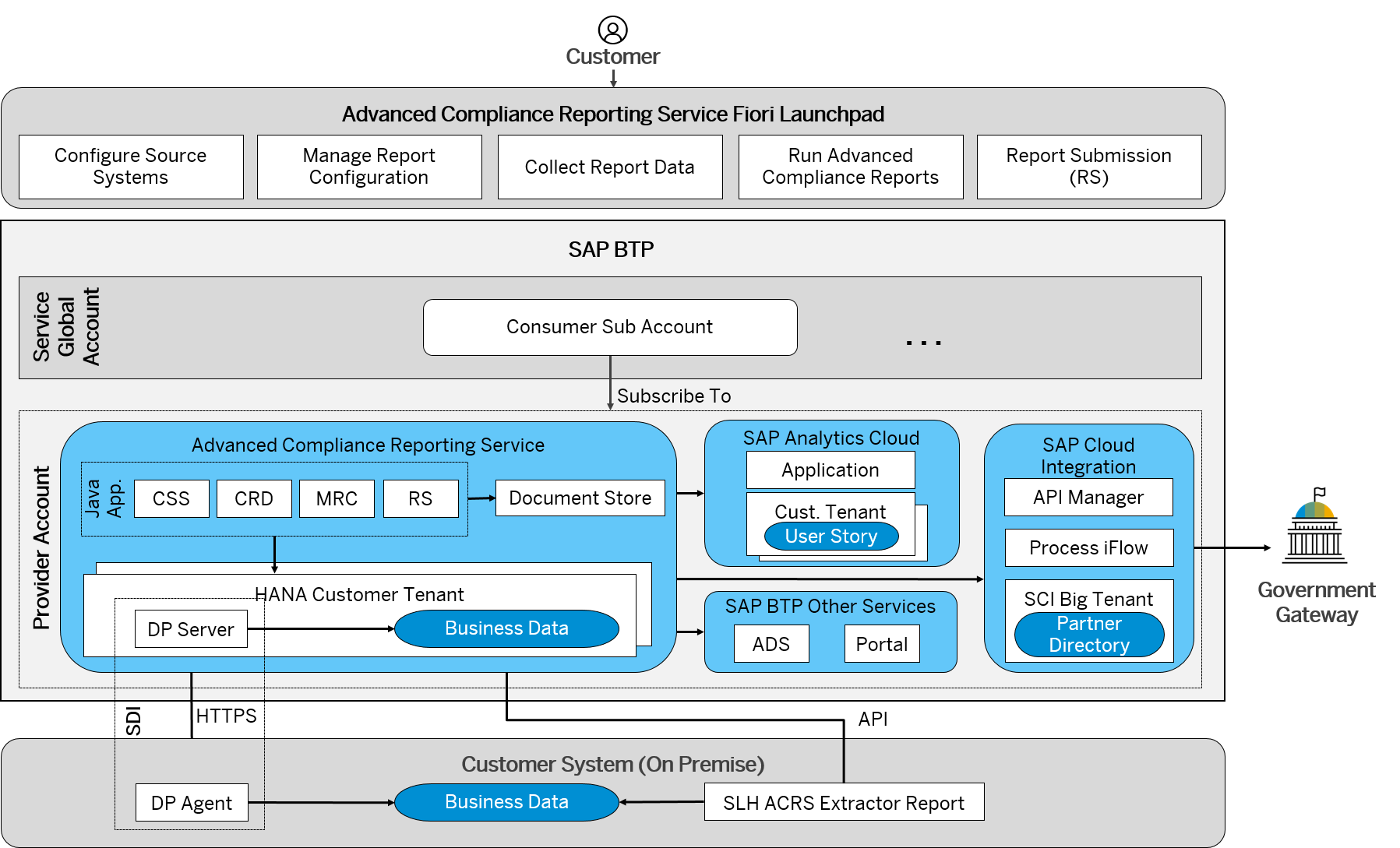

The following figure shows the high-level architecture of the service:

How KGT can provide the right solution for your indirect tax compliance requirement using SAP ACR

To ensure Indirect Tax compliance, KGT recommends the SAP Advanced Compliance Reporting (ACR) solution for SAP S/4HANA. SAP ACR is an SAP-integrated, global compliance reporting solution that helps you create, generate, and submit compliance reports periodically (e.g., monthly/ quarterly/ annually) to the governments on time and in the correct file format. It is a strategic solution, not only for SAF-T purposes but also for other tax and legal requirements. SAP ACR focuses on Statutory Compliance requirements and includes the following most essential features to ensure long-term, global compliance:

- the preparation and submission of the required reports by:

- collecting the required SAP summary data,

- generating the different required tax reports,

- converting these reports into the legally required file format (XML, XBRL, TXT, JSON, PDF, …).

- SAP OSS notes to ensure 100% long-term compliance in case of legal updates.

SAF-T VAT is part of Indirect Tax Compliance. SAF-T files are generated in a standard readable and easily exportable format regardless of the software used according to a defined set of accounting records. Within Advanced Compliance Reporting (ACR), the tool automatically collects all the required tax and invoice data. It generates the required XML SAF-T file by the country-specific requirements. The Dashboard within ACR will connect via web services to the tax authorities and generate a direct interface if required by law. In this case, the system/dashboard is updated by status notifications straight from the tax authorities. Typical SAF-T File Format:

- General Ledger – Journals

- Accounts Receivable – Customer Master Files, Sales Invoices & Payments

- Accounts Payable – Supplier Master Files, Purchase Invoices & Payments

- Fixed Assets – Asset Master Files, Depreciation & Revaluation

- Inventory – Product Master Files & Inventory Movements